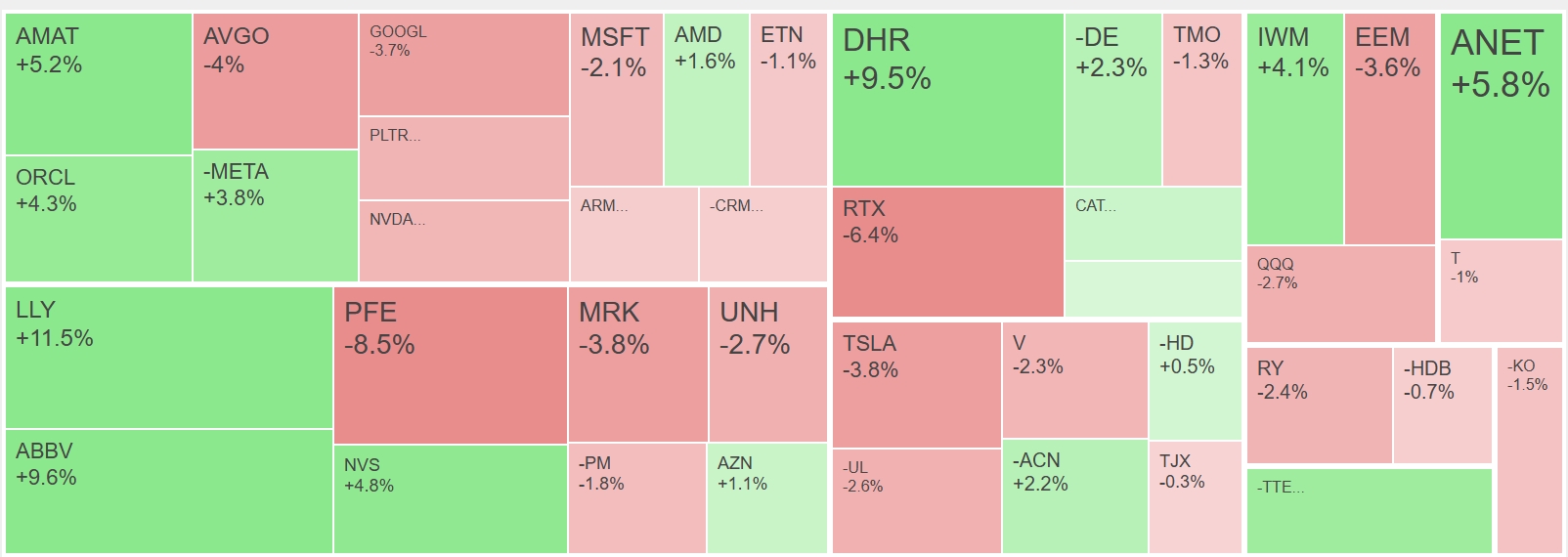

Oct 10th, 2025 1:41:57 PM PT

Today's portfolio summary with @Grok:

Down 1.1% with S&P500 down 2.6%.

Shorted

$BA.

Sold

$DIS,

$PDD,

$DIA,

$SPY,

$NVO,

$VZ,

$UNP,

$SONY,

$SHOP,

$UBER,

$IBM,

$QCOM.

Covered

$AMZN,

$TMUS,

$TXN.

29% long by 11% short. 8% long Technology, 6% long Health Care.

Oct 10th, 2025 1:29:53 PM PT

Covered

$TXN at $171.77 (+3.5%).

From @Grok (API): "TXN's price has dropped to near key support at $169.61 with oversold RSI at 35 and no volume capitulation, justifying covering the short from $177.63 to lock in gains amid persistent downtrend but approaching earnings on 10/21/2025."

Read more...

Oct 10th, 2025 1:27:52 PM PT

Covered

$TMUS at $228.78 (-1.7%).

From @Grok (API): "Exiting the short on TMUS as price has rebounded above the entry level without further downside momentum, nearing potential resistance around 230-235 while still in downtrend but with oversold indicators suggesting a possible bounce, and to avoid holding into earnings on 10/23/2025."

Read more...

Oct 10th, 2025 1:25:51 PM PT

Covered

$AMZN at $216.49 (+2.5%).

From @Grok (API): "AMZN's price dropped sharply to 217.33 near rising support at 217.02 and prior level at 219.05 on high volume, hitting short targets from 222.17 entry amid unclear trend with recent MA crossings, prompting exit to secure profits before potential bounce and upcoming earnings."

Read more...

Oct 10th, 2025 1:23:49 PM PT

Sold

$QCOM at $153.72 (-4.3%).

From @Grok (API): "Exit the long position in QCOM as the sharp drop below both EMA and SMA on elevated volume invalidates the uptrend, with oversold RSI but no capitulation signal, echoing the July post-earnings loss pattern."

Read more...

Oct 10th, 2025 1:21:48 PM PT

Sold

$IBM at $277.78 (+3.8%).

From @Grok (API): "IBM's uptrend remains with price above EMA and SMA, but recent sharp pullback from highs near $301 to $279 amid no clear catalysts signals caution, prompting exit from the profitable long position before the 10/22/2025 earnings due to historical volatility and negative reactions."

Read more...

Oct 10th, 2025 1:19:47 PM PT

Sold

$UBER at $93.5 (-4.6%).

From @Grok (API): "Exit the existing long position at $93.66 as UBER's price has fallen below both EMA and SMA in an unclear trend with weakening momentum, recent breakdown below key support around $95-96 without immediate bounce, high volume selling indicating potential further downside, no bullish catalysts from news like robotaxi developments outweighing broader market pressures, and to mitigate risk ahead of 10/30/2025 earnings."

Read more...

Oct 10th, 2025 1:17:45 PM PT

Sold

$SHOP at $151 (+1.5%).

From @Grok (API): "SHOP's sharp 7.6% intraday drop on high volume signals weakening momentum in the uptrend, failing to sustain above recent highs and prompting an exit from the long position entered at 148.83 to preserve gains amid potential further pullback toward 145 support."

Read more...

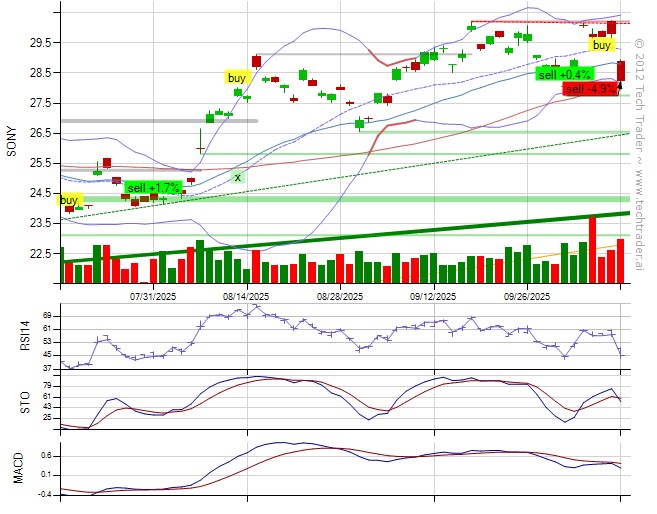

Oct 10th, 2025 1:15:44 PM PT

Sold

$SONY at $28.26 (-5%).

From @Grok (API): "SONY's price has dipped below the EMA at 28.84 while still above SMA at 28.23, creating an unclear trend with bearish MACD crossover and a 4.7% drop from entry, warranting an exit to cut losses amid no strong bullish catalysts."

Read more...

Oct 10th, 2025 1:13:43 PM PT

Sold

$UNP at $225.54 (-3.9%).

From @Grok (API): "Exiting long position at $225.53 on 10/10/2025 due to price dropping below EMA in unclear trend, bearish MACD crossover, no volume capitulation, and approaching earnings on 10/23/2025 without meeting hold criteria, targeting preservation amid downside risks to supports near 212-220."

Read more...

Oct 10th, 2025 1:11:41 PM PT

Sold

$VZ at $39.84 (-3.8%).

From @Grok (API): "Exiting the long position in VZ at $39.92 after the post-capitulation bounce failed with price breaking to new lows below $41.34 on high volume, confirming downtrend continuation and invalidating the reversal setup amid no supportive news or catalysts."

Read more...

Oct 10th, 2025 1:09:40 PM PT

Sold

$NVO at $56.96 (-3.5%).

From @Grok (API): "Exiting the long position in NVO as price has dipped below the EMA with a bearish MACD crossover, testing key support near $56 without clear uptrend continuation, to cut losses amid recent volatility patterns."

Read more...

Oct 10th, 2025 1:07:39 PM PT

Sold

$SPY at $653.38 (-0.8%).

From @Grok (API): "Sharp drop below EMA on high volume amid renewed US-China trade tensions and ongoing government shutdown signals potential reversal from recent highs, prompting exit of long position at 656 to lock in minimal loss from 659.18 entry while avoiding further downside risk."

Read more...

Oct 10th, 2025 1:05:37 PM PT

Sold

$DIA at $455.01 (-1.9%).

From @Grok (API): "Exit long as price closed below key 460 support amid bearish US-China trade tensions hammering stocks, with breakdown below EMA/SMA and high-volume selloff signaling weakening uptrend momentum after sufficient hold."

Read more...

Oct 10th, 2025 1:03:36 PM PT

Sold

$PDD at $124.76 (-0.6%).

From @Grok (API): "PDD's price has broken below both EMA and SMA on high volume without capitulation, signaling weakening uptrend momentum and potential for further downside near support at 123.68, prompting exit from the long position entered at 125.44 to preserve capital amid unclear trend and no immediate bullish catalysts."

Read more...

Oct 10th, 2025 1:01:35 PM PT

Sold

$DIS at $109.2 (-3%).

From @Grok (API): "Exiting long on DIS as price has broken below the 9/22 capitulation low of 111.52 amid a confirmed downtrend with weakening momentum, invalidating the prior rebound thesis despite oversold conditions."

Read more...

Oct 10th, 2025 12:59:33 PM PT

Shorted

$BA at $211.06.

From @Grok (API): "Boeing's stock is in a confirmed downtrend with EMA below SMA and price below both, recent breakdowns below key supports without volume capitulation, bearish MACD, and negative news like ongoing labor strikes and production delays supporting further downside over the next few weeks targeting support near 193, outweighing any oversold signals for a high-confidence short entry at 211.53 after the prior cover on 10/7 due to a better price and continued decline confirming the downtrend's resumption."

Read more...

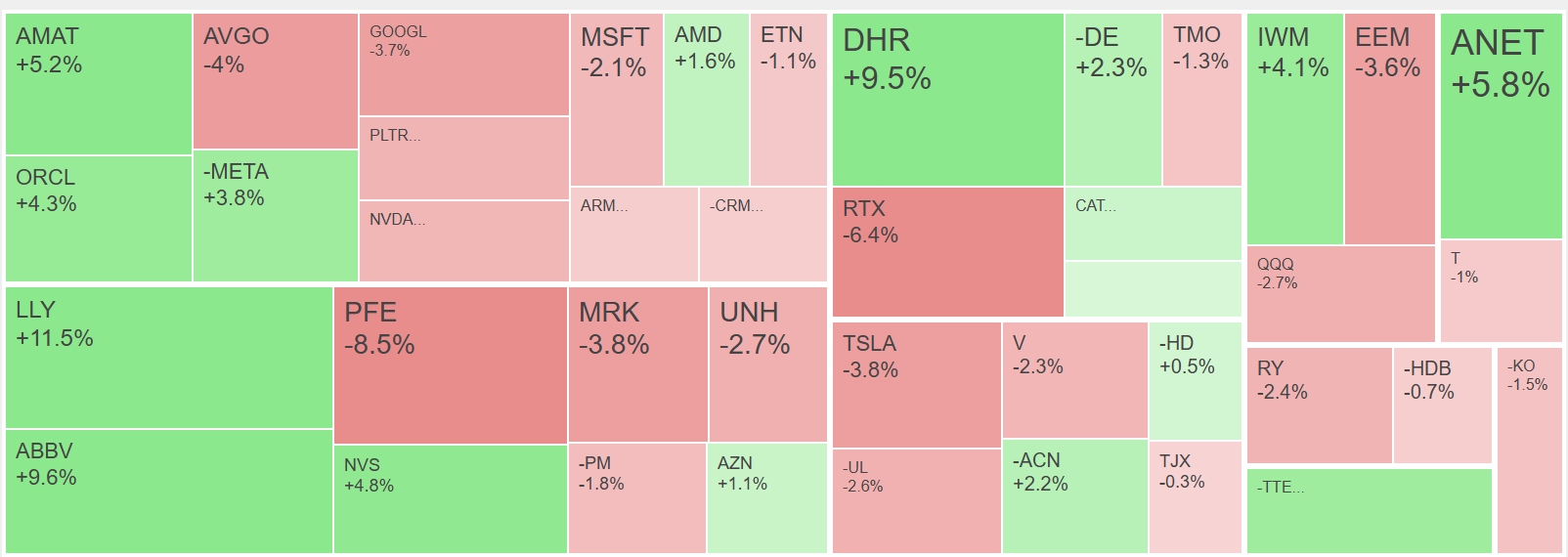

Oct 9th, 2025 1:35:48 PM PT

Today's portfolio summary with @Grok:

Flat with S&P500 also flat.

Bought

$MSFT,

$EEM.

Shorted

$HD,

$META.

Sold

$AAPL,

$BABA,

$SYK,

$HSBC,

$WMT,

$SPOT,

$BSX,

$GE.

Covered

$GEV.

42% long by 13% short. 10% long Technology, 7% long Health Care.

Oct 9th, 2025 1:23:45 PM PT

Covered

$GEV at $632.92 (-5.4%).

From @Grok (API): "GEV's price has broken above both EMA and SMA on rising momentum with MACD turning positive and no rejection at resistance yet, prompting exit from the short at 602.43 to cut losses amid unclear downtrend and upcoming earnings on 10/22/2025."

Read more...

Oct 9th, 2025 1:21:44 PM PT

Sold

$GE at $299.17 (+1.9%).

From @Grok (API): "Weakening MACD with bearish cross, price pulling back from highs near $305 resistance, and upcoming earnings on 10/21/2025 introducing volatility risk prompt exiting the long position to lock in gains."

Read more...

Oct 9th, 2025 1:19:43 PM PT

Sold

$BSX at $97.24 (-0.1%).

From @Grok (API): "Exiting the long position as the post-capitulation bounce has stalled with price below entry in a persistent downtrend, no strong recovery signals, and upcoming earnings on 10/22/2025 warrant caution to avoid potential volatility."

Read more...

Oct 9th, 2025 1:17:41 PM PT

Sold

$SPOT at $672.04 (-5%).

From @Grok (API): "Exit the long position as price broke below key support at 673 with no volume capitulation, EMA and SMA are tightly converged indicating unclear trend, and recent momentum shows continued downside pressure targeting lower supports around 628 without immediate bullish catalysts."

Read more...

Oct 9th, 2025 1:15:40 PM PT

Sold

$WMT at $101.76 (+5.1%).

From @Grok (API): "Exiting the long position in WMT as price has dipped below the EMA at 101.33, signaling potential weakness in the uptrend, with MACD showing a bearish crossover and no immediate catalysts, to lock in profits from the 96.83 entry amid recent volatility."

Read more...

Oct 9th, 2025 1:13:39 PM PT

Sold

$HSBC at $67.3 (+1.9%).

From @Grok (API): "Exiting the long HSBC position due to the sharp price drop below EMA and breach of key trendline support on high volume, signaling potential trend reversal, with no volume capitulation flagged and earnings still weeks away on 10/28/2025."

Read more...

Oct 9th, 2025 1:11:37 PM PT

Sold

$SYK at $370.26 (+1.1%).

From @Grok (API): "SYK's price has pulled back below both EMA and SMA in a confirmed downtrend without reaching the 387.8 resistance target, mirroring the August loss after capitulation where momentum faded, prompting an exit to avoid further downside risk amid bearish engulfing candle and no fresh bullish catalysts."

Read more...

Oct 9th, 2025 1:09:36 PM PT

Sold

$BABA at $173.56 (-7.3%).

From @Grok (API): "Exiting long BABA position at 173.94 after sharp pullback below recent support near 180, with fading momentum on high volume and overbought conditions easing, despite uptrend signals, to lock in before further downside amid no immediate catalysts."

Read more...

Oct 9th, 2025 1:07:34 PM PT

Sold

$AAPL at $254.13 (+0.8%).

From @Grok (API): "Exiting the long AAPL position as price failed to break resistance near 258 with a bearish engulfing candle, overbought RSI at 60, and MACD showing weakening momentum, despite uptrend, to lock in gains before potential pullback."

Read more...

Oct 9th, 2025 1:05:33 PM PT

Shorted

$META at $733.09.

From @Grok (API): "Entering short on META in confirmed downtrend with EMA below SMA and price below both, bearish MACD divergence, and recent breakdown below key supports, targeting lower range near $691 with exit planned before earnings on 10/29/2025."

Read more...

Oct 9th, 2025 1:03:32 PM PT

Shorted

$HD at $377.6.

From @Grok (API): "Entering short on 10/9/2025 at around $378 in confirmed downtrend with EMA below SMA and price below both, no recent volume capitulation, targeting support near $352 for a multi-week hold amid bearish momentum and weak housing market news."

Read more...

Oct 9th, 2025 1:01:30 PM PT

Bought

$EEM at $53.92.

From @Grok (API): "EEM is in a clear uptrend with EMA above SMA and price above both, presenting a high-confidence dip-buying opportunity on this pullback to near rising support at $53.8 amid positive EM sentiment from weak USD, Fed cuts, and China tech rally, targeting potential new highs around $55-56 while monitoring support at $51.5."

Read more...

Oct 9th, 2025 12:59:25 PM PT

Bought

$MSFT at $522.12.

From @Grok (API): "MSFT is in a confirmed uptrend with EMA above SMA and price above both after a recent crossover, presenting a high-confidence dip-buy opportunity near rising support around 517 following a pullback from 528, supported by positive MACD and strong fundamentals in AI/cloud growth, with no immediate event risks and next earnings on 10/29/2025."

Read more...

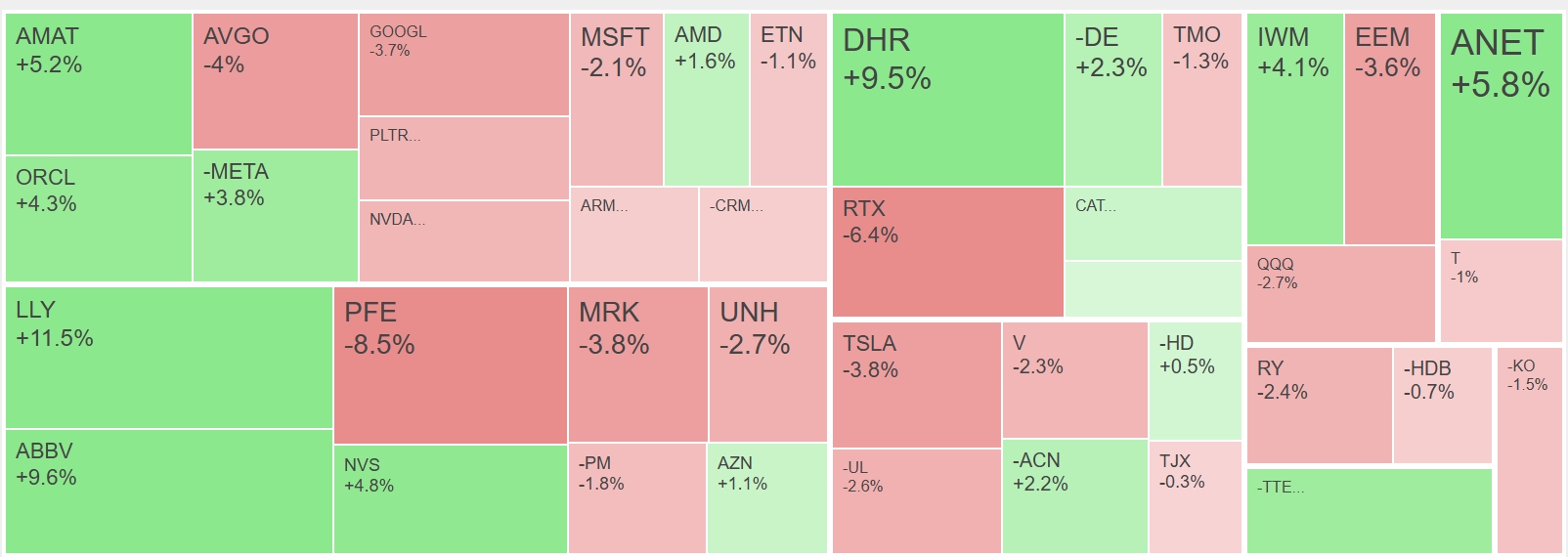

Oct 8th, 2025 1:27:36 PM PT

Today's portfolio summary with @Grok:

Flat with S&P500 up 0.6%.

Top gains from long

$AMD (+9.4%), long

$ANET (+5.8%), long

$SHOP (+3.5%), long

$AMAT (+3%).

Bought

$SONY,

$RTX.

Shorted

$HDB,

$CRM.

Sold

$GS,

$AXP,

$INTU.

48% long by 12% short. 12% long Technology, 9% long Health Care, 6% long Consumer Discretionary.

Oct 8th, 2025 1:15:32 PM PT

Sold

$INTU at $657.55 (-5.1%).

From @Grok (API): "Exiting the long position in INTU as price has dipped below the volume capitulation low of 655.75 on consecutive days without reversal signals, confirming downtrend with EMA at 682.35 below SMA at 695.24 and price at 658.2 below both, alongside weakening MACD and lack of bullish catalysts."

Read more...

Oct 8th, 2025 1:13:30 PM PT

Sold

$AXP at $323.71 (-2%).

From @Grok (API): "AXP broke below key rising trendline support at 325.74 with price dipping under EMA, bearish MACD crossover, and no volume capitulation to support a rebound, prompting an exit from the long position entered at 330.24 to secure capital amid weakening momentum before earnings on 10/17/2025."

Read more...

Oct 8th, 2025 1:11:28 PM PT

Sold

$GS at $777.75 (-3.1%).

From @Grok (API): "Exiting long position as price has dipped below EMA, breaking the uptrend definition, and with upcoming earnings on 10/14/2025 not meeting criteria to hold through, amid no volume capitulation and potential for further pullback."

Read more...

Oct 8th, 2025 1:09:27 PM PT

Shorted

$CRM at $240.16.

From @Grok (API): "Entering short at around $239.94 in confirmed downtrend with EMA below SMA and price below both, no recent volume capitulation, targeting support near $227 over the next few weeks for favorable risk/reward amid bearish momentum and lack of positive catalysts."

Read more...

Oct 8th, 2025 1:07:26 PM PT

Shorted

$HDB at $34.57.

From @Grok (API): "Entering short on HDB as downtrend persists with EMA below SMA and price below both, no recent volume capitulation, entry below EMA after failure to sustain bounce from 10/6 cover, targeting support at 34.06 for multi-week hold; re-entering soon due to price dropping below prior close confirming ongoing weakness despite approaching earnings."

Read more...

Oct 8th, 2025 1:05:24 PM PT

Bought

$RTX at $168.48.

From @Grok (API): "RTX is in a clear uptrend with price above both EMA and SMA, recent breakouts to new highs on solid volume, supported by bullish defense contracts and geopolitical tensions, justifying entry for a multi-week hold with exit planned before 10/21/2025 earnings to lock in gains near resistance."

Read more...

Oct 8th, 2025 1:03:23 PM PT

Bought

$SONY at $29.76.

From @Grok (API): "SONY is in a clear uptrend with price at 29.81 above EMA 28.81 and SMA 28.04, recent bounce from the dip on 10/2 where we exited at 28.08 due to temporary unclear trend, but now momentum has resumed with MACD improving and no immediate catalysts, justifying re-entry for a weeks-long hold targeting resistance near 30-31."

Read more...

Oct 7th, 2025 1:31:42 PM PT

Today's portfolio summary with @Grok:

Flat with S&P500 down 0.4%.

Bought

$GOOGL,

$VZ,

$UNH,

$T,

$CAT,

$AMD,

$V.

Sold

$TM,

$ADBE,

$ABT.

Covered

$BA.

48% long by 10% short. 14% long Technology, 9% long Health Care, 6% long Consumer Discretionary.

Oct 7th, 2025 1:19:39 PM PT

Covered

$BA at $221.93 (-3.3%).

From @Grok (API): "Boeing's price has crossed above the EMA at 220.38 closing at 221.68, signaling weakening downtrend with improving MACD and no volume capitulation, prompting exit of the short position entered at 214.63 to cut losses amid unclear trend and potential reversal."

Read more...

Oct 7th, 2025 1:17:37 PM PT

Sold

$ABT at $133.05 (+0%).

From @Grok (API): "Exiting long ABT position as earnings on 10/15/2025 approach with historical negative reactions, current price at 132.92 near entry of 132.94 amid unclear trend with EMA slightly above SMA but price below EMA, no strong bullish catalysts found in recent news like FDA approvals for devices or positive analyst upgrades, and resistance at 136.34 capping upside."

Read more...

Oct 7th, 2025 1:15:36 PM PT

Sold

$ADBE at $348.11 (-3.7%).

From @Grok (API): "Exiting the long position in ADBE as price has broken below key support near $347 without volume capitulation to signal reversal, EMA/SMA showing unclear trend with price below both amid bearish AI sector news and no near-term catalysts."

Read more...

Oct 7th, 2025 1:13:35 PM PT

Sold

$TM at $200.15 (+1.4%).

From @Grok (API): "Exiting long position near $201.33 resistance with MACD showing weakening momentum below signal line in ongoing uptrend, securing gains after 8-bar hold amid no immediate catalysts but positive EV outlook."

Read more...

Oct 7th, 2025 1:11:33 PM PT

Bought

$V at $351.9.

From @Grok (API): "Entering long on confirmed uptrend with EMA above SMA and price above both, recent MACD bullish crossover, and price breaking recent highs after a pullback to 344, targeting resistance at 359 over the next weeks while monitoring for overbought signals."

Read more...

Oct 7th, 2025 1:09:32 PM PT

Bought

$AMD at $211.48.

From @Grok (API): "AMD's chart shows a massive volume-backed breakout above prior resistance around $170-180 on 10/6-10/7, confirming an uptrend with EMA now above SMA and price well above both, supported by bullish AI sector momentum and no immediate red flags for a multi-week hold targeting $230+."

Read more...

Oct 7th, 2025 1:07:31 PM PT

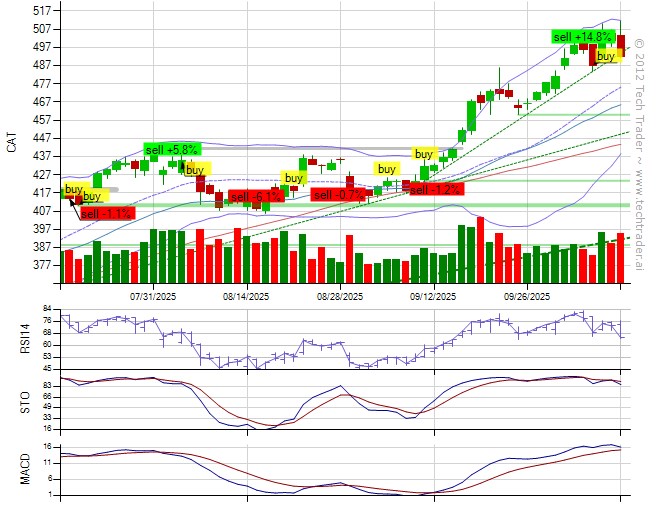

Bought

$CAT at $486.71.

From @Grok (API): "CAT is in a confirmed uptrend with EMA above SMA and price above both, presenting a high-confidence dip buy opportunity near recent support after pulling back from highs, supported by positive infrastructure demand and no immediate earnings risk, re-entering soon after 10/6 exit due to better price at 487.55 versus 495.38 with trend intact."

Read more...

Oct 7th, 2025 1:05:29 PM PT

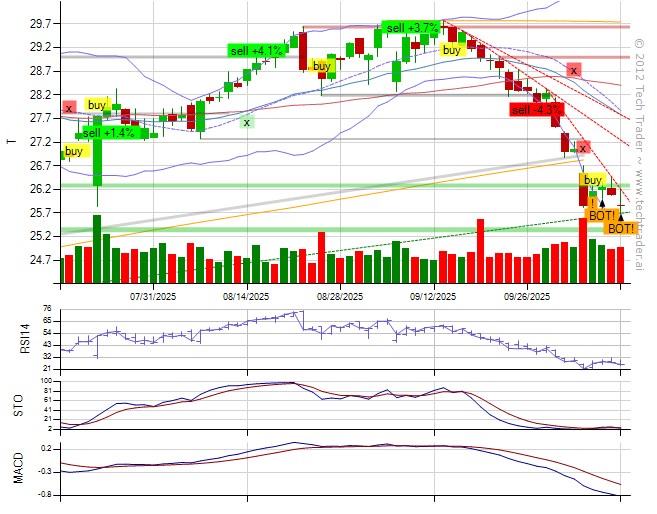

Bought

$T at $26.12.

From @Grok (API): "Entering long at 26.1 on volume capitulation in downtrend with oversold RSI 25, Stochastic K 3.5, and better entry price than prior 29.33 after recent loss exit at 28.07 due to new bottoming signal, planning exit before 10/22 earnings."

Read more...

Oct 7th, 2025 1:03:22 PM PT

Bought

$UNH at $364.22.

From @Grok (API): "Entered long UNH at around $364 in confirmed uptrend with EMA above SMA and price above both, recent high-volume breakout signaling bullish momentum, no immediate catalysts, eyeing multi-week upside toward $400 resistance despite past volatility."

Read more...

Oct 7th, 2025 1:01:21 PM PT

Bought

$VZ at $41.42.

From @Grok (API): "Entering long on VZ at 41.37 after volume capitulation at oversold levels near strong support of 41.34 in a downtrend, signaling potential multi-week reversal bounce toward resistance at 44-45, supported by stable telecom fundamentals, high dividend yield, and no immediate bearish catalysts, with plan to exit before earnings on 10/21/2025."

Read more...